To view the full infographic, click here

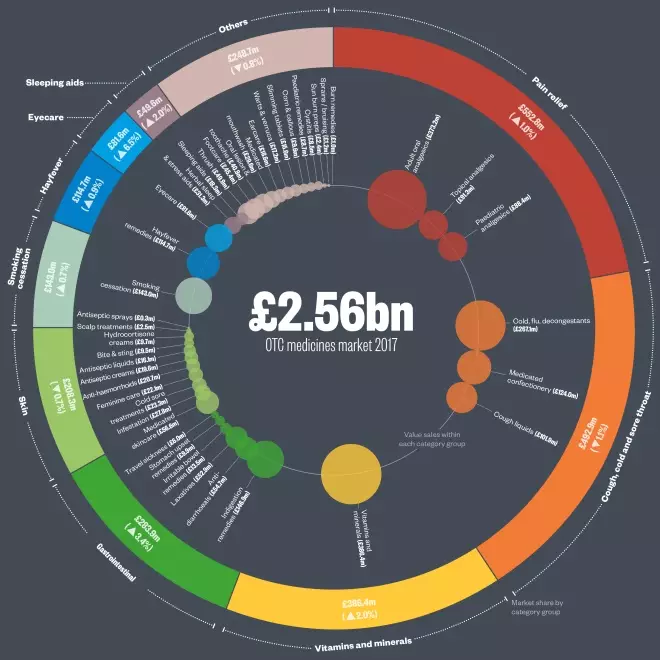

OTC medicines market in 2017

Source: Nielsen Scantrack, 52 weeks to 30 December 2017

The three largest category groups in terms of sales in 2017 were pain relief (22%), cough, cold and sore throat (19%) and vitamins and minerals (15%)

Top brands and manufacturers

The charts below show the top 10 brands within five popular categories and the companies that dominate these categories.

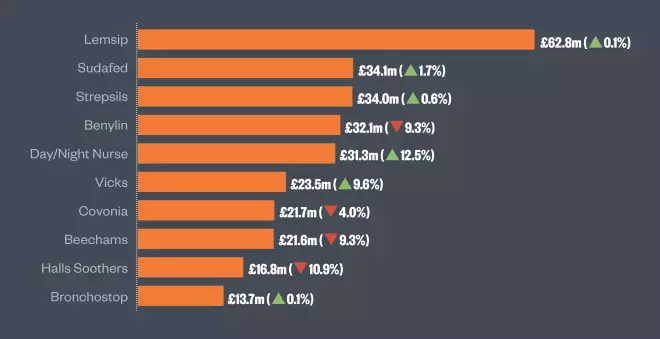

Top brands: cold, flu, decongestants in 2017

Source: Nielsen Scantrack, 52 weeks to 9 September 2017

Lemsip leads the top 10 cold, flu, decongestants category, with growth of 0.1% compared with 2016. Benylin, Covonia, Beechams and Halls Soothers retain their top 10 ranking despite falls in sales

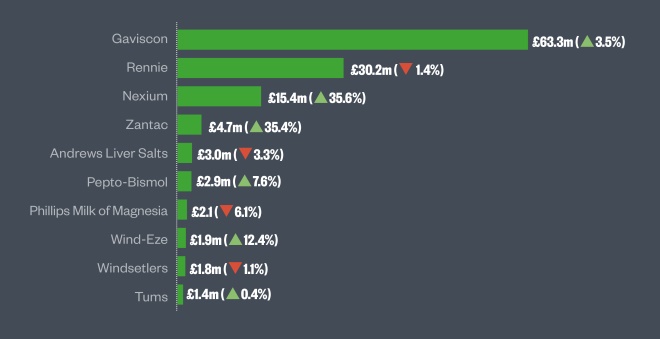

Top brands: indigestion remedies in 2017

Source: Nielsen Scantrack, 52 weeks to 9 September 2017

Nexium and Zantac both saw around a 35% increase in sales compared with 2016 but Gaviscon remained the top brand in this category

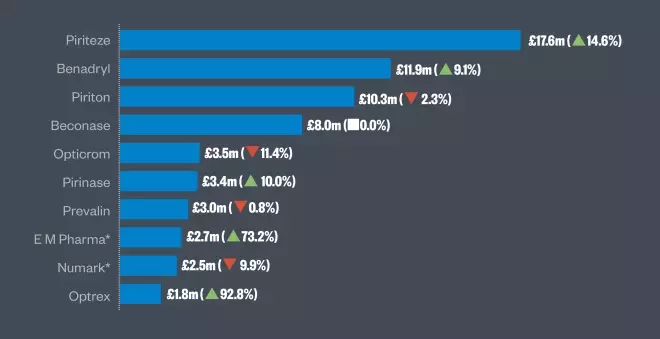

Top brands: hayfever in 2017

Source: Nielsen Scantrack, 52 weeks to 9 September 2017. *These products are generic brands

Piriteze is the top-selling brand in the hayfever category and saw a 15% increase in sales compared with 2016

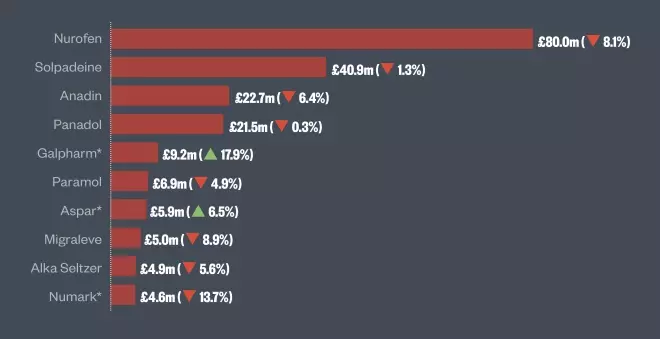

Top brands: adult oral analgesics in 2017

Source: Nielsen Scantrack, 52 weeks to 9 September 2017. *These products are generic brands

Sales of the top 10 adult oral analgesics have decreased compared with 2016, with the exception of Galpharm and Aspar brands, which have increased

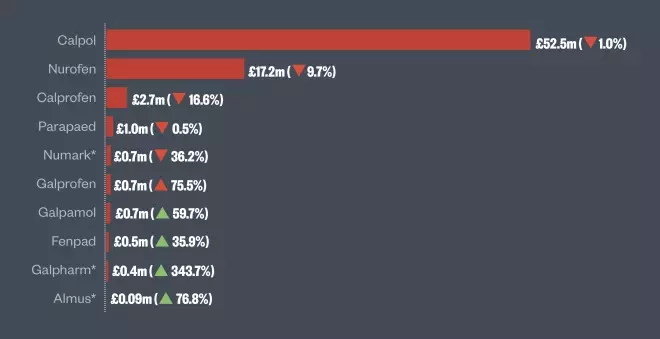

Top brands: paediatric analgesics in 2017

Source: Nielsen Scantrack, 52 weeks to 9 September 2017. *These products are generic brands

The top three paediatric pain relief brands remain the same in 2017, despite a fall in sales value for each. Calpol leads, with more than three times the sales of its closest competitor Nurofen

Top OTC brand manufacturers in 2017

Source: Nielsen Scantrack, 52 weeks to 9 September 2017

RB dominates with Nurofen, Lemsip and Gaviscon. Johnson & Johnson is its closest competitor, with Calpol, Sudafed and Benylin

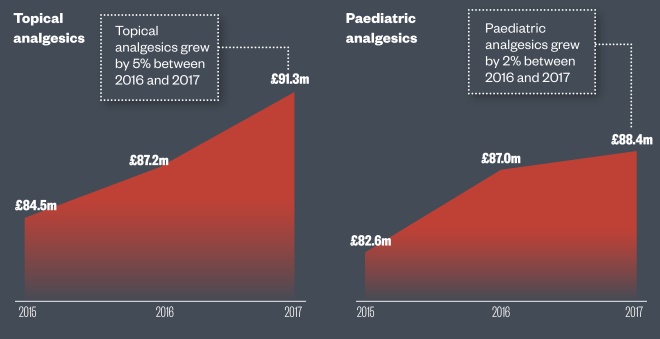

Targeted pain relief takes off

Source: Nielsen Scantrack, 52 weeks to 30 December 2017

Both topical and paediatric pain relief categories grew during 2017, while adult oral analgesics stagnated.

References

Source: Nielsen Scantrack, which covers all independent and multiple pharmacies, supermarkets (including in-store pharmacies) and impulse stores in Great Britain. These data originate from a different source to those used for our previous over-the-counter market infographics so they are not directly comparable.

Infographic: MAG